Forever 21 3d Room Design Tool

A look at the evolution of the fashion industry and where technology is taking it next, from AR/VR dressing rooms to temperature-changing smart fabrics and beyond.

Fashion has always been at the forefront of innovation — from the invention of the sewing machine to the rise of e-commerce. Like tech, fashion is forward-looking and cyclical.

Estimated to be worth more than $3T by the end of the decade, according to CB Insights' Industry Analyst Consensus, the fashion sector is also one of the largest industries in the world.

And today, fashion technology is growing at a faster pace than ever.

Robots that sew and cut fabric, AI algorithms that predict style trends, VR mirrors in dressing rooms, and an array of other innovations show how technology is automating, personalizing, and speeding up the fashion space.

In this report, we dive into the trends reshaping how our clothes and accessories are designed, manufactured, distributed, and marketed.

Table of Contents

-

- Product Design

- AI becomes the designer

- How AI is influencing brands

- Manufacturing

- What fast fashion means for seasons

- The push for sustainability in fashion

- Rapid iteration & production

- Streamlining the fashion supply chain

- 3D printing personalized apparel products

- New robot designs for the fashion manufacturing floor

- Inventory & Distribution

- RFID for verification, automation, & online integration

- Blockchain in the fashion supply chain

- Apparel distribution scales down

- D2C fashion brands shun physical retail

- From ownership to usership: The rise of clothing-as-a-service

- Automated warehouses

- Retail & Virtual Merchandising

- AR/VR redefines the online and in-store experience

- Digital stylists get personal

- What's Next? High-Tech Fashion Trends To Watch

- Wearable tech: Jewelry, apparel, & footwear

- Virtual fashion

- 3D scanning in the apparel industry

- Novel fabrics

- Synthetic media

- Cryptocurrencies

- Livestreaming and mining social media

- Closing thoughts

- Product Design

Product Design

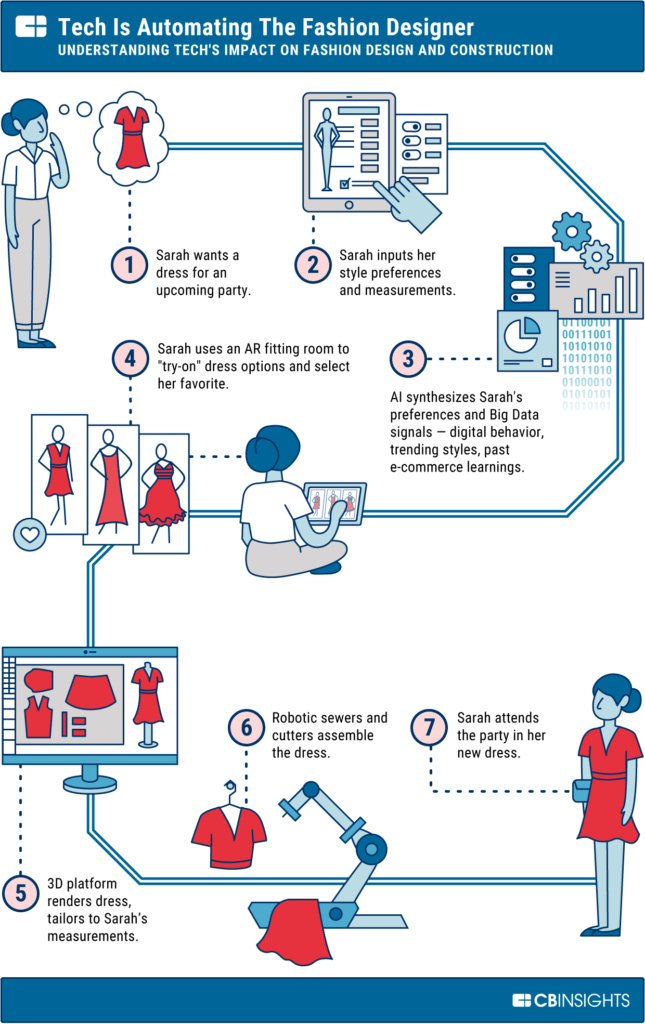

Tech is automating the fashion designer

Fashion brands of all sizes and specialties are using technology to understand customers better than ever before.

As those data collection efforts grow more sophisticated, artificial intelligence will reshape brands' approach to product design and development, with a focus on predicting what customers will want to wear next.

Outside of fashion, manufacturers are already using AI to generate out-of-the-box prototypes for products ranging from aircraft parts to golf equipment. Generative design software is expected to be a $44.5B market by 2030, per CB Insights' Industry Analyst Consensus.

AI Becomes The Designer

Google has already tested the waters of user-driven AI fashion design with Project Muze, an experiment it deployed in partnership with Germany-based fashion platform Zalando in 2016.

The project trained a neural network to understand colors, textures, style preferences, and other "aesthetic parameters," derived from Google's Fashion Trends Report as well as design and trend data sourced by Zalando.

From there, Project Muze used an algorithm to create designs based on users' interests and aligned with the style preferences recognized by the network.

Amazon is innovating in this area as well. One Amazon project, led by Israel-based researchers, would use machine learning to assess whether an item is "stylish" or not.

Another, out of Amazon's Lab126 R&D arm in California, would use images to learn about a particular fashion style and create similar images from scratch.

If that sounds like "fast fashion by Amazon," that's because it probably is. In 2017, the e-commerce giant patented a manufacturing system to enable on-demand apparel-making. The tech could be used to support its Amazon Essentials line or the suppliers in Amazon's logistics network.

Of course, the outcomes of human-free AI design aren't always runway-ready. Many designs created for users of Google's Project Muze were unwearable scrawls and scribbles, while some reports on the Amazon Lab126 initiative called the design results "crude."

Furthermore, using algorithms to generate clothing has backfired at times. In 2019, for instance, it was unveiled that a number of online T-shirt vendors were deploying bots to scrape images (under which people had commented "I want this on a T-shirt" or the like) and uploading them to marketplaces to be produced and sold on-demand. This quickly drew criticism and allegations of copyright violation and IP theft.

Nevertheless, the gap between AI-developed designs and human-made ones is closing. In April 2019, an AI "designer" called DeepVogue placed second overall and won the People's Choice Award at China's International Fashion Design Innovation competition. The system, designed by China-based technology firm Shenlan Technology, uses deep learning to produce original designs drawn from images, themes, and keywords imported by human designers.

The Tokyo-based design consultancy firm Synflux has also been using AI to come up with innovative designs in a project called Algorithmic Couture. The team, consisting of designers and software engineers, built a tool that creates customized clothing in a series of steps.

First, the software 3D scans a body to capture its proportions. Then, machine learning algorithms analyze the collected data to come up with garment patterns intended to reduce fabric waste. In the last step, designers model these 2D patterns using computer-aided design (CAD) software and produce fashion patterns that can be used to sew clothing items.

An example of a dress design generated by Synflux's software. Source: Dezeen

Synflux's approach is envisioned as delivering personalized designs that go beyond the typical division of small, medium, and large sizes — with minimized fabric waste, as the software optimizes the design for each customer.

More R&D is needed before brands can rely on AI-only designers. But today's artificial intelligence is already helping brands create and iterate their designs more quickly.

How AI Is Influencing Brands

In 2018, Tommy Hilfiger announced a partnership with IBM and the Fashion Institute of Technology. The project, known as "Reimagine Retail," used IBM AI tools to decipher:

- Real-time fashion industry trends

- Customer sentiment around Tommy Hilfiger products and runway images

- Resurfacing themes in trending patterns, silhouettes, colors, and styles

Knowledge from the AI system was then served back to human designers, who could use it to make informed design decisions for their next collection.

"Reimagine Retail was a powerful example of what happens when fashion partners with a global tech leader to advance challenging innovations." — Michael Ferraro, director of the FIT/Infor DTech Lab

Stitch Fix is already at the forefront of AI-driven fashion with its "Hybrid Design" garments. These are created by algorithms that identify trends and styles missing from the Stitch Fix inventory and suggest new designs — based on combinations of consumers' favorite colors, patterns, and textiles — for human designers' approval.

The company details how it works (shown below) in the "Algorithms Tour" on its website.

Source: Stitch Fix

The company has said that the AI-designed pieces perform comparably in "keeper" sales to the garments from its fashion-brand suppliers. That's likely because Stitch Fix has such vast troves of customer data informing its AI, thanks to its subscription-based, feedback-focused business model.

"We're uniquely suited to do this," said Eric Colson, chief algorithms officer at Stitch Fix. "This didn't exist before because the necessary data didn't exist. A Nordstrom doesn't have this type of data because people try things on in the fitting room, and you don't know what they didn't buy or why. We have this access to great data and we can do a lot with it."

Design isn't the only area where Stitch Fix is putting AI and machine learning initiatives to work. The company employs a team of more than 120 to oversee machine learning algorithms that are used to inform everything from client styling to logistics to inventory management.

According to Colson, the company is already seeing ROI from its AI investments, including increased revenue, decreased costs, and improved customer satisfaction. Stitch Fix reported net revenue of $1.7B in 2020, an 11% increase year over year.

As more and more AI "assistance" programs advance, they will help brands make smarter strategic decisions around product development and new business lines.

3D design platforms like CLO also make it easy to tweak designs on the fly. These allow brands to use real-time AI insights to modify fashions right up to the minute they hit production.

Below, we illustrate how tech is automating away the fashion designer, as styles become more personalized and influenced by digital signals.

Similar to Amazon's Lab126 initiative and Google's Project Muze, scientists from UC San Diego and Adobe have outlined a way for AI to learn an individual's style and create customized computer-generated images of new items that fit that style.

The system could enable brands to create personalized clothing for a person based solely on their engagement with visual content.

At a more macro level, it could also allow a brand to predict broader fashion trends based on historical data from its entire user base. The predictions could ultimately be used to guide the design of a product or an entire label.

The next era of fashion is all about personalization and prediction. With more and more data, algorithms will become trend hunters — predicting (and designing) what's next in ways that have never been possible.

True Fit, for example, closed a $55M Series C round in 2018 to bring its total equity funding to $102M. The company's big data platform facilitates capabilities like AI-powered fashion discovery and exact-fit clothing and shoe recommendations.

With over 100M registered users, the platform uses transaction data to determine customer preferences that "better personalize all touchpoints of the consumer journey" for brands, according to CEO William R. Adler.

Virtusize, another company capitalizing on the smart fitting trend, enables online shoppers to buy the right size, either by measuring the clothes in their closet or by comparing specific brands and styles to their own.

Virtusize claims that, by removing uncertainty around size and fit, it can increase average order values by 20% and decrease return rates by 30%. The Japan-based company counts Balenciaga and Land's End among its clients, as well as Zalora — a leading online fashion store in Asia.

Ultimately, consumer preferences will guide every aspect of the design and production process.

Platforms like True Fit may help identify the types of materials shoppers prefer, or even pinpoint how important sourcing and manufacturing conditions are to a unique shopper.

Manufacturing

Fast fashion has created an instant gratification mentality

Since World War II, fashion has been broken up into seasons: Spring/summer lines debut on runways in early fall, while autumn/winter lines debut in February.

The staggered timeline is designed to give brands enough time to gauge the interest of retail buyers and customers. In the time between when fashions are introduced and when they arrive on store shelves, brands assess demand so that they can manufacture the right number of garments for the season.

Fast fashion, in which designs move quickly from catwalk to store shelves, has upended that model.

Brands like Zara and H&M built their businesses on speed and agility. Once these retailers spot a new trend, they can deploy their hyper-rapid design and supply chain systems to bring the trend to market as quickly as possible.

This allows fast fashion brands to beat traditional labels to market. Garments and accessories strutted down runways in September and February may get spotted and replicated by fast fashion brands before the originals even hit stores.

With a nearly real-time ability to get the newest styles on shelves, fast fashion brands can push out broader varieties of clothing styles to cater to the preferences of smaller, more targeted segments of customers. They can also push smaller runs to test the waters for customer demand, or sell collections for hyper-short lifespans.

And cheap alternatives to high-fashion items remain hot consumer commodities. Even amid the retail slowdown — and the economic uncertainty of the Covid-19 pandemic — Zara's owner reported over $23B in revenue in 2020, beating analyst estimates. H&M also posted a profit in 2020, thanks to a rapid rebound in business.

What Fast fashion Means For seasons

The rise of fast fashion is decimating the biannual seasonality that has long structured the fashion industry. In order to keep up, traditional apparel brands are now debuting around 11 seasons a year.

Fast fashion brands, on the other hand, may issue as many as 52 weekly "micro-seasons" per year. Topshop, for example, used to introduce around 500 styles per week on its website before its parent company, Arcadia Group, went bankrupt. Zara produces 20,000 new styles in a year.

Social media is accelerating this cycle. Influencer marketing and other social media strategies help new trends travel fast, creating rapid consumer demand for hyper-cheap fashions.

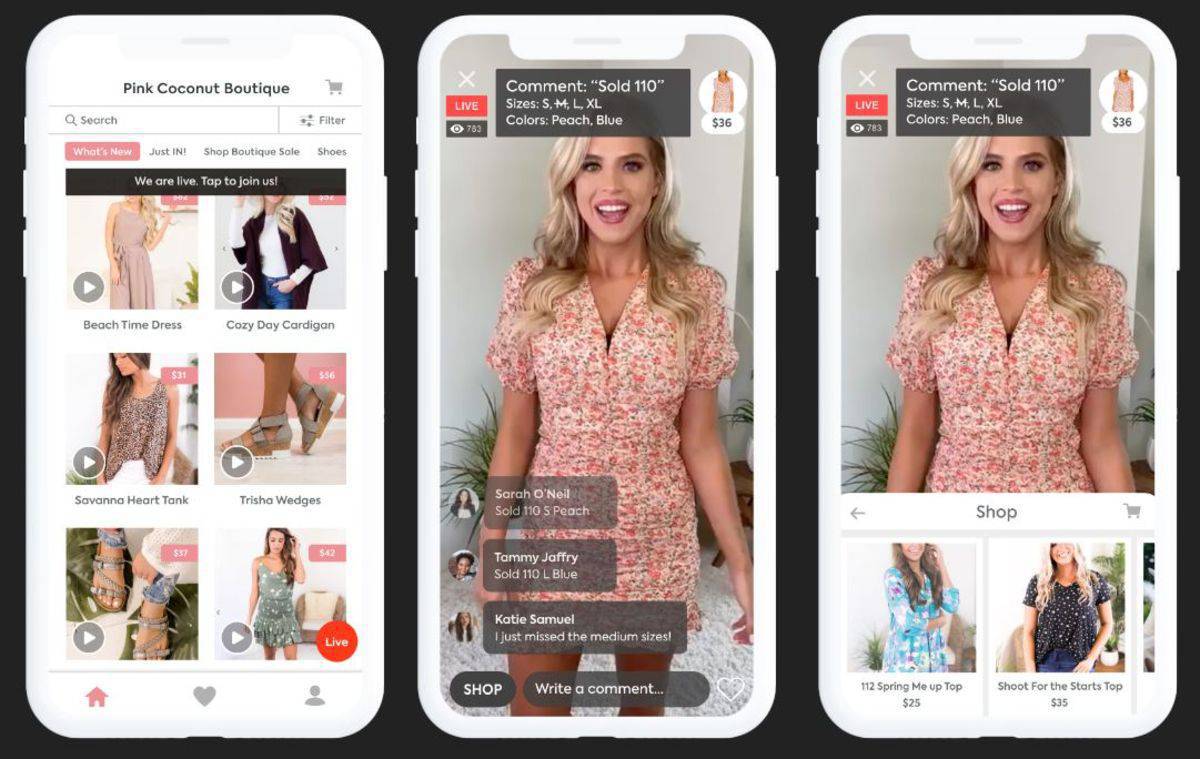

Shoppers act on that demand instantly, thanks to "See Now, Buy Now" tools on platforms like Instagram and Pinterest. Adept social media strategies on TikTok have translated to strong sales for companies like Fashion Nova, PrettyLittleThing, and Shein.

Fashion Nova is one example of a fast fashion e-commerce brand that has successfully leveraged social media to build its customer base and its brand. The company has more than 19.9M followers on Instagram, as well as more than 3,000 influencers, known as #NovaBabes, promoting its clothes. It reportedly spent $40M in 2019 on influencer marketing alone.

Fast fashion brand Boohoo has seen significant results by investing in influencer marketing, saying that its profits doubled after paying celebrities to promote its products on Instagram to 16- to 24-year-old fans.

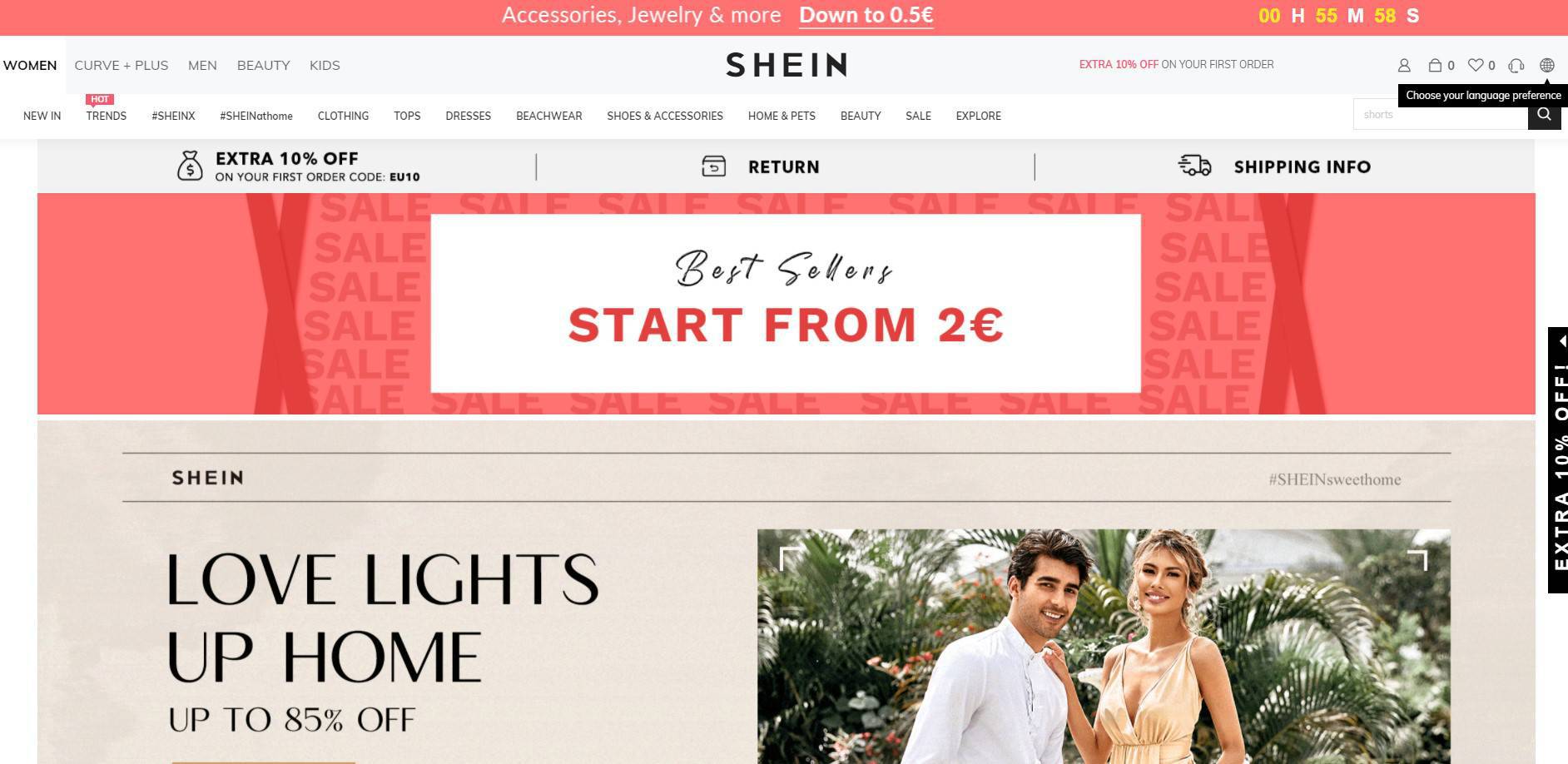

Shein, in particular, has grabbed fast fashion market share from legacy players like Zara and H&M. The Nanjing-based shopping site has grown into the world's largest online-only fashion business, "measured by sales of self-branded products," according to the market research company Euromonitor.

Fast fashion brand Shein is taking on legacy players with fast deliveries and low prices. Source: Shein

Shein aims to take only 3 days to produce and ship designs. Zara's parent company, Inditex, takes an average of around three weeks to move designs from drawing board to store.

And customers are flocking to Shein, attracted by low prices and a constant stream of fresh designs. In October 2020, the company's Android and iOS apps had 229M downloads, compared to H&M's 124M and Zara's 91M, according to Sensor Tower.

Yet fast fashion has a dark side. Many fast fashion brands manufacture low-cost, low-quality apparel in factories with questionable working conditions, relying on workers who receive low pay.

Cheaply-made apparel can also cause environmental damage since rapid production runs of low-durability clothes promote excessive textile waste. According to the Environmental Protection Agency, some 12.8M tons of clothing is sent to landfills annually.

The global fashion industry emits 2.1B metric tons of greenhouse gases annually, according to McKinsey. This represents about 4% of total annual global greenhouse gas emissions — more than international flights and maritime shipping combined. The fashion industry is responsible for up to 10% of global CO2 emissions, 20% of the world's industrial wastewater, 24% of insecticides, and 11% of pesticides used, according to some estimates.

While the sustainability issues within fashion — and fast fashion in particular — are not new, what's changing is how the industry's most influential customers are starting to respond.

The Push for Sustainability in Fashion

Sustainability has become a crucial emerging trend across sectors in the past few years. Sustainability-marketed products drove more than half the growth in the consumer packaged goods (CPG) industry between 2015 and 2019, despite making up just 16% of the market, according to the NYU Stern Center for Sustainable Business. In 2021, CPG items marketed as environmentally friendly further increased their share of US in-store purchases to 16.8%, worth over $130B.

Consumers are wising up to the negatives of fast fashion: Socially conscious shoppers are embracing the growing movement of "slow fashion," which focuses on sustainable materials and transparent, ethical labor and manufacturing.

Fashion shopping app Lyst has seen a 37% increase in searches for sustainability-related keywords in early 2020 compared to the year before, with average monthly searches topping 32,000, up from 27,000 in 2019.

The growing concern about sustainability is particularly prominent among younger generations: 83% of millennials in the US value companies implementing programs to improve the environment, according to the Conference Board Global Consumer Confidence survey. And 75% are willing to change consumption habits for more sustainable offerings. Similarly, 73% of Generation Z consumers are willing to pay more for sustainable items, per First Insight.

Young, up-and-coming brands in the fashion space are making moves to align with this shift in consumer sensitivities. Sustainable activewear brand Girlfriend Collective emphasizes transparency and sells items like leggings made of recycled polyester. Switzerland-based On is planning on launching fully recyclable shoes in fall 2021, paired with a subscription model to further close the recycling loop.

Other brands like Everlane and Reformation have also catapulted to popularity by marketing themselves on sustainability and ethics.

Responding to this consumer demand, a number of prominent brands have also announced new clothing lines and initiatives focused on sustainability:

- H&M has pledged to only use recycled or sustainable materials by 2030. It also announced its Treadler initiative in March 2020, which will allow other brands to access its global supply chain — providing smaller companies the economies of scale needed to produce garments sustainably. H&M's former head of sustainability, Helena Helmersson, stepped into the CEO role in February 2020, signaling the fashion retailer's aim to take sustainability more seriously.

- Levi's Wellthread x Outerknown collection is piloting products with 30% "cottonized" hemp and jackets with detachable hardware to make them more easily recyclable. Additionally, the company's Water<Less(R) Denim line was created to reduce the amount of water used in producing some of the brand's most popular styles and fits.

- In 2019, Adidas released 200 pairs of its Futurecraft.Loop sneakers, a 100% recyclable line of running shoes — though it ran into challenges as people didn't bring the shoes back. The company also plans to use recycled plastic waste to produce 17M pairs of shoes in 2021, up from 15M in 2020.

A shift to more sustainable materials is not the only way the fashion industry is embracing more environmentally-friendly practices.

Resale and consignment platforms like Depop, ThredUp, and Poshmark that allow people to buy and sell used clothes have gained popularity as sustainability becomes more important for consumers.

ThredUp went public in March 2021, raising $168M. The company boasts around 2.4M listings from more than 35,000 brands and reported $186M in revenue in 2020.

Online secondhand shopping is set to grow 69% between 2019 and 2021, compared to a 15% contraction in the broader retail market, according to a report by online consignment platform ThredUp. The secondhand clothing market is expected to grow to $64B by 2028, per CB Insights' Industry Analyst Consensus.

Big-name retailers are catching on. In August 2020, London-based retailer Selfridges announced a sustainability plan that includes eco-friendly clothes, a clothing rental service, and a secondhand shop. H&M-owned brand Cos has launched its own resale business as well. Meanwhile, fashion brands like Anna Sui, Rodarte, and Christopher Raeburn have begun selling on the Depop resale platform in an effort to capture Gen Z shoppers.

AI and advanced technologies may also have a part to play in the push for sustainability in fashion.

For example, better demand forecasting can allow for more efficient use of materials, cutting down on the volume of wasted resources — a historical problem in fashion supply chains. H&M launched an AI department in 2018 to tackle precisely this problem.

H&M uses AI in other ways as well to make its retail operations more efficient and sustainable. The Swedish retail giant relies on algorithms to predict market demand, avoid overproduction of clothes, and set competitive prices. The company is also using AI-based predictive analytics to automate warehouses and to offer faster deliveries in Europe.

Another area these technologies could improve is returns, which is currently a significant source of waste within the fashion industry (and the e-commerce segment in particular). Customers return up to 40% of clothing and shoes purchased online, according to reverse logistics company Happy Returns. With data and AI capabilities, retailers could more effectively match customers' shopping behavior and preferences, potentially reducing the overall number of returns.

Alternative materials — like plant-based, lab-grown leather — could also play a big role in making the fashion industry more sustainable.

There are many tech-driven efforts in this field. For instance, Modern Meadow, a US-based biotech company that has raised more than $180M, ferments special types of yeast to grow collagen — one of the main components of conventional leather — and then processes this protein to create a leather material that doesn't involve livestock in its supply chain.

Bolt Threads produces a leather-like fabric called Mylo and a silk-like fabric called Microsilk. Source: Bolt Threads

Bolt Threads is another startup using proteins gathered from mushrooms in nature to create a leather-like fabric called Mylo. Jamie Bainbridge, the company's VP of product development, says, "When you touch our material, you get the same feeling as when you're touching a natural leather. If nobody told you whether it was leather or not, you would sit there and try to decide if it was."

Bolt has drawn interest from a group of fashion and retail brands, including Stella McCartney, Adidas, Lululemon, and Kering. These brands will use Mylo in products that could hit shelves in 2021.

Rapid ITERATION & PRODUCTION

The costs of starting a fashion brand have gone down significantly, thanks to technology and e-commerce.

Manufacturing marketplaces, for one, can leverage AI to give feedback on whether designs are feasible and provide estimates on cost and production time, potentially eliminating months of back-and-forth with suppliers.

Further, the dawn of the Etsy online marketplace made it easy for anyone to start an online shop and build a following. Now, decreased production costs make it feasible for small or emerging brands to manufacture small runs of products at reasonable margins and build up online audiences from there.

In years past, fashion labels would have to manufacture hundreds or thousands of items in order to produce them at a reasonable price.

"In mass production, more product equals more money. Vendors tend to be less responsive to small-quantity orders unless they are specifically set up for that scale." — Eric Schneider for the American Society for Mechanical Engineers

Now, startups like Maker's Row make it simple for small labels to find small-batch manufacturing partners that can meet their needs at scale, with transparent standards around pricing and sourcing. Emerging brands can weave small-batch runs (and transparent production standards) into their marketing.

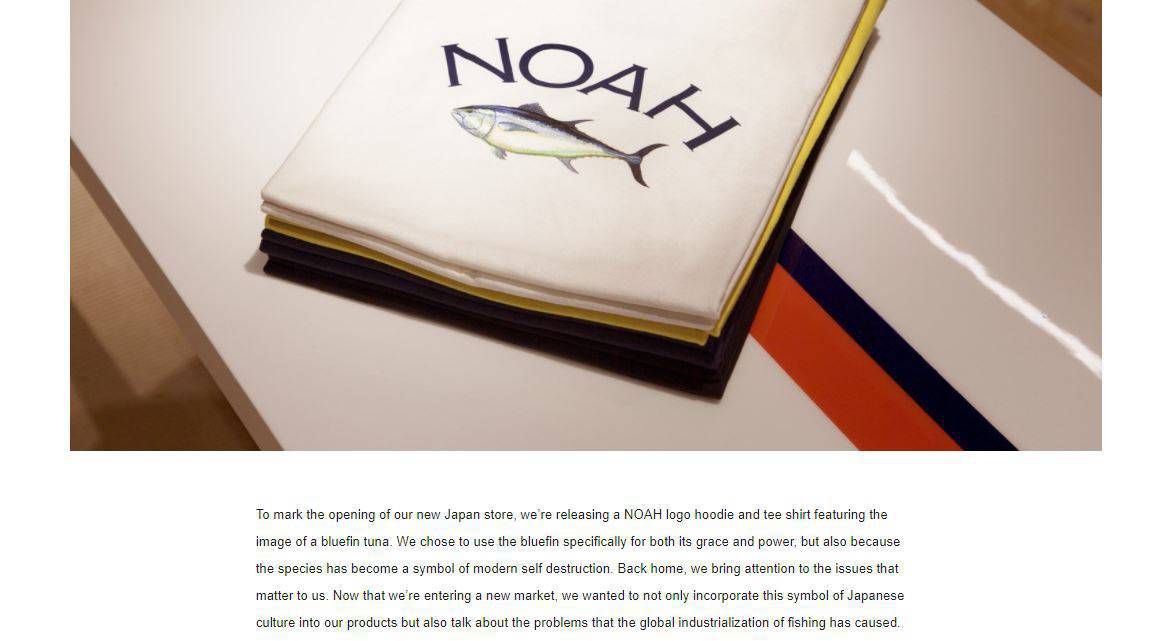

NYC-based menswear line Noah, for example, produces ultra-small batch clothing lines — rumored to sometimes comprise as few as 12 or 24 items — and often sell out of these items quickly. The launches include detailed blog posts about the items' sourcing and purpose.

Source: Noah

Large high-end brands are also evolving their approach to production to better compete with fast fashion retailers.

Tommy Hilfiger makes the fashions in its TommyNow line available instantly — all around the world, in-store and online — as soon as they sashay down the runway.

That means TommyNow items hit stores 3 times faster than traditional collections, with just a 6-month window between product ideation/design and release.

"It's about delivering on the instant gratification that consumers are really seeking," says Avery K. Baker, chief brand officer at Tommy Hilfiger. "Closing that gap between the visibility of a fashion show and the moment of purchase."

The Hilfiger brand has gone all in on making the Now line experiential and immediate.

The first TommyNow collection — a collaboration with model Gigi Hadid — launched in 2016 with a 2-day Fashion Week extravaganza that supported a huge social media push. The event livestream was made "shoppable" for Facebook Live and was supplemented with instantly buyable product debuts on Pinterest, Instagram, and Snapchat.

Many other brands aim to follow TommyNow's example, but this is no easy feat. Shortening an 18-month production window into just 6 months required the Tommy Hilfiger brand to overhaul its entire design, manufacturing, and distribution ecosystems.

Yet plenty of technologies are emerging to make scalable, sustainable production more feasible, at a faster pace.

Streamlining the fashion supply chain

Some brands are "internalizing" production to quicken the pace of manufacturing and meet consumer demand more rapidly.

In April 2018, Gucci launched Gucci Art Lab, a 37,000-square-meter product development and lab testing center with in-house prototyping and sampling activity for leather goods, new materials, metal hardware, and packaging. The project's aim is to bring the Gucci supply chain closer to home — ultimately giving the brand greater control over product development, sampling, and material development.

Vertical integration has helped companies from Peloton and Apple to Netflix and Tesla drive growth. Peloton, for one, shifted away from its original plan of fitting software onto existing bikes, instead designing a custom bike, relying on company-owned manufacturers, and integrating various other features like production studios and retail outlets.

The Covid-19 crisis has also highlighted the risks of single sourcing. Companies saw production come to a complete standstill as the pandemic swept through China, where many multinationals source their items.

But in cases where supplier diversification isn't possible, AI is becoming increasingly critical for supply chain monitoring.

AI companies are leveraging natural language processing (NLP) to scour news, government databases, trade journals, and more to monitor for supply chain disruptions, including natural disasters or factory mishaps. Machine learning is also being used to generate risk scores for vendors based on their supply chain network.

For example, startups like Interos and Resilinc curate databases on vendor business relations and use machine learning to evaluate risk scores based on their supply chain networks. We dive deeper into how manufacturers can use AI to lower risk in sourcing and procurement in this analysis, as part of our client-only AI in manufacturing series.

3d printing personalized apparel products

Brands are exploring how 3D printing can help them produce goods on demand and create new avenues for customization.

Performance professional apparel brand Ministry of Supply unveiled an in-store 3D printer that creates customized knitwear (and can produce a customized blazer in just 90 minutes). Printing the garments reduces fabric waste in production by about 35%.

Adidas has also partnered with Carbon to create 3D-printed soles for its Futurecraft sneakers, bypassing the need for traditional models and prototypes. Adidas also invested in Carbon through its Hydra Ventures arm in Q4'17.

In October 2020, Adidas unveiled STRUNG, a prototype for a new 3D-printed running shoe. The STRUNG sneakers can be customized to fit an individual athlete's foot and are promoted as being more eco-friendly. Adidas plans to develop a range of STRUNG sneakers for various sports, with a launch date scheduled for 2022.

Adidas's prototype 3D-printed running shoe called STRUNG. Source: Adidas

New Balance and Reebok have launched similar initiatives. New Balance teamed up with HP in January 2020 to print personalized insoles based on scanned biometric data. In March 2018, Reebok released the limited edition Liquid Floatride Run shoe, the first product to market out of the company's 3D printing concept, Liquid Factory. The shoe features 3D-printed "laces," Liquid Grip on the sole, and the company's new Flexweave material.

"Footwear manufacturing hasn't dramatically changed over the last 30 years," says Bill McInnis, head of future at Reebok. "Every shoe, from every brand is created using molds — an expensive, time-consuming process.

"With Liquid Factory, we wanted to fundamentally change the way that shoes are made, creating a new method to manufacture shoes without molds. This opens up brand new possibilities both for what we can create, and the speed with which we can create it."

new robot designs for the fashion manufacturing floor

As with pretty much every other industry, automation and robotics are also coming for fashion manufacturing. They're already in the warehouse: Many brands use automated storage and retrieval systems (ASRS) for stocking and transporting inventory.

Using robots in garment manufacturing, however, has been more challenging.

Robo-cutting fabrics has been possible for years, but sewing presents a challenge, as hard robots have difficulty working with pliable, elastic fabrics.

Advances in soft robotics will infiltrate garment-making in the future. In the meantime, startups are combining hardware and software to create automated sewing systems.

SoftWear Automation, for example, is developing "Sewbots" equipped with robotic arms, vacuum grippers, and specialized "micromanipulators" that can guide a piece of cloth through a sewing machine with submillimeter precision.

The Sewbots use specialized cameras and computer vision software to track individual threads at 1,000 frames per second. (In one contract, the startup brought a supplier's T-shirt manufacturing costs down to just $0.33 a shirt.)

In February 2019, SoftWear announced Sewbots-as-a-Service, which allows manufacturers, brands, and retailers to rent the fully automated sewing workline. The program is intended to enable US-based companies to source and manufacture in the US at a lower cost than outsourcing, with greater predictability and quality.

Robots have long been used in shoemaking, but Nike doubled down on robo-manufacturing with its 2013 investment in Grabit, a robotics startup that uses electroadhesion (which works using static electricity) to help machines manipulate objects in novel ways.

Since then, Nike has started using Grabit's technology to assemble a sneaker's "upper" — the flexible part of the shoe that sits atop the foot. The upper is highly technical to manufacture and has typically been an area where human intervention is necessary.

Meanwhile, Adidas opened 2 robotic "Speedfactories" — one in Germany and one in the US — in 2016 and 2017, respectively. However, it has since announced it would stop production and turn over the tech to its suppliers in Asia. The Speedfactories faced a couple of major challenges: First, they were only able to produce a limited number of designs; second, it proved more difficult to abruptly change production lines in robotic factories vs. human-powered ones.

By embracing manufacturing systems that rely more on machines and less on humans, fashion brands are wanting to speed up production while looking to minimize concerns around labor conditions in their facilities.

Inventory & Distribution

Tech makes inventory in the fashion industry more transparent and traceable

As fashion enters its next era, goods produced using hyper-rapid manufacturing systems will be tracked and distributed using next-gen inventory management tools.

Brands are increasingly deploying a combination of sensors, scanners, and cloud-based software to monitor and maintain inventory. Radio frequency identification technology (RFID tagging) is one approach likely to see widespread adoption.

Source: Macy's

RFID FOR VERIFICATION, AUTOMATION, & online integration in fashion retail

RFID tags are cheap, battery-free smart stickers that can be used for digital cataloging. Unlike barcodes, the signals from RFID tags can be read from some distance away, decreasing the time it takes to manually log items.

After failed attempts by Walmart and JC Penney to deploy RFID at scale in the early 2000s, a number of companies have integrated the technology.

Since starting an RFID initiative in 2009, it took Macy's around 8 years to get 100% of all items in every store tagged. The retailer is working with suppliers to tag merchandise at the assembly site, enabling better tracking to reduce lost inventory and out-of-stock incidents.

"With an increase in the inventory accuracy, out-of-stocks are significantly reduced," said Bill Connell, Macy's SVP for store operations & process improvement. "And by cutting the out-of-stocks, item availability is increased, which can lead to substantial and measurable sales increases."

Some of Macy's suppliers — especially luxury brands — have also been using RFID to fight counterfeiting, as well as to analyze where garments are purchased.

Italy-based luxury label Moncler, for example, outfits its products with RFID chips (shown left) that customers can authenticate via an app or website — creating a tangible way to distinguish Moncler goods from knock-offs. Brands like Benetton and Salvatore Ferragamo have pursued similar programs.

Italy-based luxury label Moncler, for example, outfits its products with RFID chips (shown left) that customers can authenticate via an app or website — creating a tangible way to distinguish Moncler goods from knock-offs. Brands like Benetton and Salvatore Ferragamo have pursued similar programs.

Automated stocking with RFID is also making fast fashion even faster: Zara's RFID system encodes each garment on the manufacturing floor, allowing for the highly targeted tracking of item sales, stocking, and availability.

Each time a garment is sold off the rack, Zara's system prompts the stock room to send another item out to the floor. The granularity allows online window shoppers to check if an item is in stock at a local store before making a purchase.

The ease of scanning RFID tags also makes stores more efficient: Zara reports that associates who used to spend 40 hours per store scanning barcodes can now use RFID-reading guns to log inventory in closer to just 5 hours.

Zara's approach to RFID aligns with a larger trend around shelf monitoring for retail merchandising. Startups like Repsly and Eversight use in-store cameras and/or RFID to help brands monitor the presentation of merchandise on store shelves and track the results of in-store promotions or displays. Using trend data and AI, their software then helps brands auto-optimize their promotion strategies.

Burberry, meanwhile, has integrated RFID tags into more than just tracking and verification, using them to make shopping in stores more experiential and engaging.

Products in Burberry's 450+ worldwide retail stores are fitted with RFID tags that can communicate with the Burberry app, which offers users suggestions for how to wear or use them. In select stores, customers can view this "bespoke" multimedia content on in-store display screens.

Interactivity aside, most RFID-first approaches to supply chain improvement focus on tracking the movement of goods after manufacturing and assembly. Brands typically "chip" RFIDs into items at the "Made in ____" location, which is the last part of the production process.

Retailers aren't the only ones taking advantage of RFID. Herman Kay, manufacturer of outerwear for brands like London Fog, Anne Klein, and Michael Kors, started using RFID "after Macy's extolled the technology's virtues in 2013." According to CIO/CTO Rich Haig, RFID has drastically improved order fulfillment accuracy and made Herman Kay "a much better supplier."

As end-to-end transparency becomes more important to environmentally conscious apparel consumers, a more thorough and integrated solution will be necessary.

In fact, fashion brands' embrace of RFID may be the on-ramp for another technology: blockchain.

Blockchain In The Fashion Supply Chain

In fashion — and many other industries — blockchain tech has transformative potential.

By giving commercially produced goods a unique digital ID, or "token," on a decentralized, distributed ledger, companies can create end-to-end digital histories for their inventories. (Find out more about how blockchain tech works in our explainer.)

As materials, garments, or accessories move through the global supply chain, blockchain tracking will create accurate transaction records based on their location data, content, and time stamps. The digital IDs can be tracked using RFID tags, QR codes, or NFC tags.

Fashion brands are already exploring how blockchain tracking can inject more transparency into the garment creation process while also making it easier to verify products. In 2019, Nike, for one, patented "CryptoKicks," shoes that would be tracked and authenticated via blockchain technology.

The patent envisions that once purchased, the shoes would be linked to their owner using the Ethereum blockchain. Buyers would be provided with a non-fungible token (NFT) — unique digital assets that are tracked and verified using blockchain tech — which represents ownership of the shoe. These tokens can also contain details about shoe designs, colors, and other attributes. Aside from tapping into NFTs' popularity, the ability to digitally authenticate shoes is likely an attempt by Nike to combat counterfeiting.

And in 2017, blockchain startup Provenance piloted a fashion-blockchain project with London-based designer Martine Jarlgaard. The initiative tracked the journey of raw materials through the supply chain right up to the finished garment, logging every step from shearing wool at an alpaca farm to spinning it at a mill to assembling it at the designer's studio.

Upon scanning a garment's label, consumers can view a map of the clothing's movement through the entire manufacturing and distribution process — every step of a garment's journey to a consumer.

Provenance also provided its technology to Woolmark Prize contestants in 2020. Each designer at the Woolmark event used Provenance to enable shoppers to check how items were made and sourcing practices.

Source: Provenance

Blockchain startup VeChain worked with fashion label Babyghost on a similar initiative for the brand's summer 2017 collection. In fall 2018, H&M announced that it, too, was launching a pilot program with VeChain, using a wool beanie from the company's Arket clothing line to test product data traceability in its supply chain. H&M-owned Cos reportedly partnered with VeChain to track the origins of some of the retailer's clothes in April 2020.

For now, blockchain-backed approaches to supply chain management may be more buzz than substance. Yet as the movement toward more ethical, sustainable fashion grows, the potential for blockchain in the space is significant.

Apparel DISTRibution scales down

As the retail landscape shifts, many fashion goods won't land in a traditional retail store at all.

The fashion sector has already witnessed the demise of the mall as consumers embrace online shopping, and e-commerce continues to ravage department and apparel stores alike. The global e-commerce market is worth over $4T, according to CB Insights' Industry Analyst Consensus.

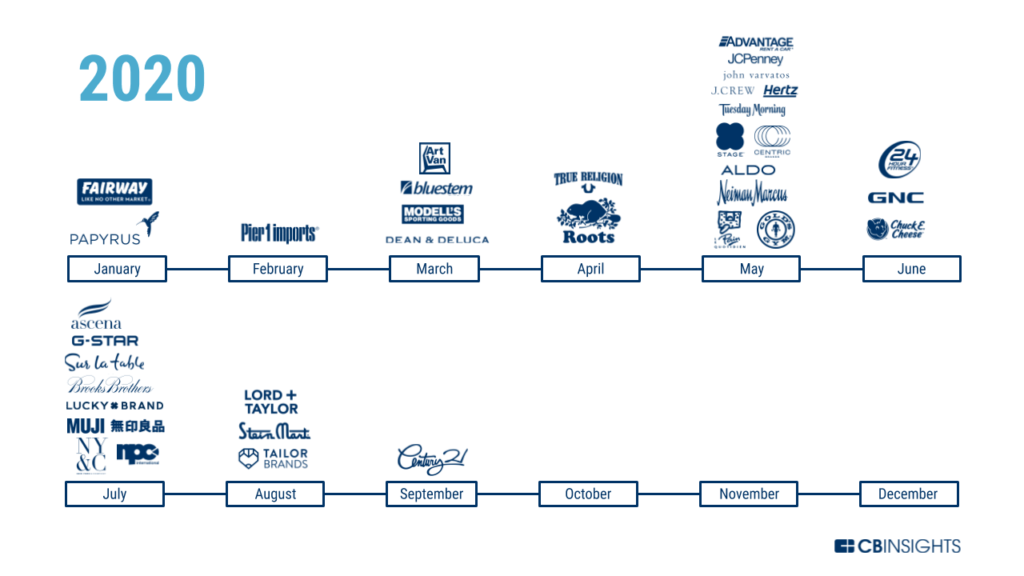

Brick-and-mortar fashion companies are feeling the pain of this transition, which has only been accelerated by Covid-19. Mall-based retailers reportedly saw earnings plunge 256% in Q2'20, according to Coresight Research. And over 12,000 US stores closed in 2020, according to real estate company CoStar Group, up from 10,000 stores the year before.

Some of the most high-profile mass closures (or announcement of mass closures) in recent years include:

- Barneys New York filed for bankruptcy in 2019 and sold its intellectual property to Authentic Brands.

- Forever 21 filed for bankruptcy in late 2019 and withdrew from 40 countries.

- Papyrus said it would shutter all 254 stores in North America in January 2020.

- In 2020, JC Penney said it expected to close about 240 of its 800+ US stores, but has since reduced this number to about 170 store closures.

- In 2020, Ascena Retail, which owns Ann Taylor and Lane Bryant, said it would close more than half of its stores — 1,600 out of 2,800 locations.

- In 2020, Pier 1 announced that it was closing all 540 of its stores and going out of business. However, its brand was eventually bought by new owners and was relaunched as an online store.

- In August 2020, Stein Mart announced it would be closing all of its 279 stores.

As retail spaces close up shop, subscription boxes are giving fashion brands a new avenue for distribution.

Services like Stitch Fix (which went public in Q4'17) and Trunk Club (acquired by Nordstrom in Q3'14) ship product assortments to members on a monthly basis. Clients can purchase the items they want to keep and send back the ones they don't. Stitch Fix reported net revenue of $490M in Q1'21, an increase of 10% year over year.

As subscribers interact with styles online, share information about their preferences, and give feedback on items they do or don't want to buy, the recommendation algorithms improve over time — like Netflix suggestions for your wardrobe.

Source: Stitch Fix

Early on in the Covid-19 pandemic, some subscription brands suffered waves of layoffs as consumers — their direct customers — faced financial troubles. However, many have since bounced back, with some even reporting higher-than-average subscription sign-ups.

Subscription boxes help brands get their goods in front of targeted groups of consumers likely to want their wares, and also represent an avenue for shoppers to explore new products as stores remain closed. But unless a brand launches its own box, it's always competing against other labels to be the "keeper" every month. The subscription box hype has also faded since its heyday, as consumers combat "subscription fatigue."

And since subscription boxes reach a much smaller audience than traditional department or apparel stores, they're still no replacement for big retail chains' enormous distribution power.

Pop-up shops are another example of a new distribution channel brands are leveraging. Brands and designers are increasingly renting or leasing empty store spaces for short-term use, typically in well-trafficked urban areas.

Pop-ups pose benefits for brands both large and small:

- For big-name companies, pop-up shops' smallness makes it possible to connect with shoppers in a more creative and intimate setting, which can help drive loyalty.

- For emerging fashion brands, pop-ups' experiential nature can help create media hype and brand awareness.

Both large and small companies can use pop-ups to gauge consumer interest before investing in a full production launch or entering a new fashion vertical.

Like the sample sales that preceded them, pop-ups also create a special sense of urgency that motivates consumers.

The results bear out in sales and engagement: In 2019, pop-ups accounted for 10% of the furniture retailer Lovesac's annual sales. And more than a third of shoppers in pop-ups opened by athletic apparel retailer Lululemon Athletica are new to the brand, showing that the pop-up approach could be a fruitful way to engage more customers.

As Covid-19 continues, pop-up stores may see a resurgence as a cheaper, more flexible solution for retailers looking to connect with shoppers.

Pop-up stores are also beginning to shift from big cities into neighborhoods to meet customers where they are. For instance, one brand saw just a tenth of its usual traffic in New York City but raked in a whole month's revenue in a week by opening a temporary location in the Hamptons, per The Lionesque Group.

Pop-ups first emerged in response to the late-2000s US economic crash, but they've grown into a global trend, even infiltrating elite fashion markets like Milan: Italian brands Furla, Genny, and Paula Cadematori are among the latest European labels to invest in temporary shops.

And the small-store phenomenon is going even more micro: Unmanned mini stores are a growing trend in China, and Stockwell (fka Bodega) aims to bring cabinet-sized stores overseen by AI to US apartment buildings and dorms.

The kiosk trend has so far focused on convenience items like food and toiletries, but it may begin to infiltrate the fashion and accessories space.

Several startups have emerged to help companies explore new distribution strategies like these. Bulletin, for one, is pioneering a "WeWork" model for retail, offering flexible options to brands that want space for their products in existing physical stores. The company divides its store locations into different sections of varying sizes (sometimes as small as a bit of shelf space). Each section can then be rented out by different businesses on a month-by-month basis.

With pop-ups and kiosks gaining momentum, hosting short-term brick-and-mortar events could help generate excitement for direct-to-consumer (D2C) fashion brands.

D2C fashion brands Shun PhySical retail

For D2C brands, pop-ups, kiosks, and traditional stores are simply the physical extensions of an online-first strategy.

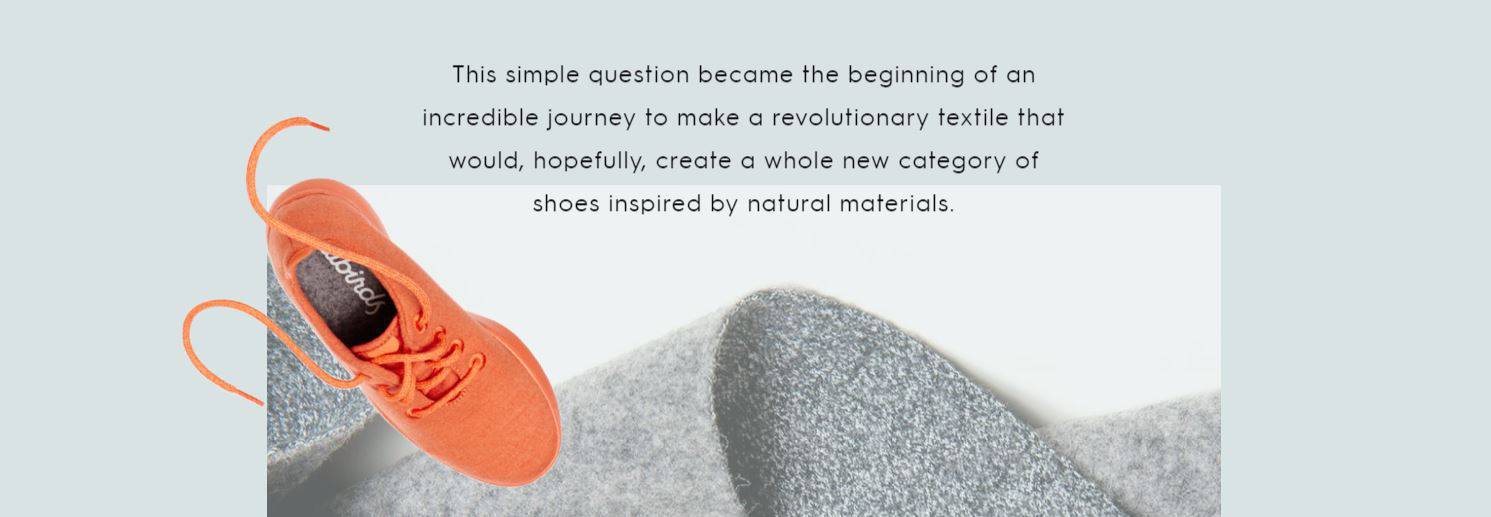

Technology has changed the meaning of "direct to consumer." It's not about catalogs or TV commercials anymore: Top D2C fashion brands like Everlane, Bonobos, and Allbirds create their own markets by growing loyal followings of customers and leveraging effective SEO, social media, and online marketing strategies.

Source: Allbirds

D2C brands often put a premium on ranking high in Google's search results, turning Instagram followers into advocates, and using Facebook engagement (as well as highly targeted ads) to continually expand their reach.

D2C brands then use e-commerce tools and exclusivity-based marketing tactics to launch promotions and drive digital sales:

- Highly visual platforms drive interest, and "See Now, Buy Now" buttons drive immediate sales conversions.

- Items are often made-to-order, with customers selecting from different options or adding personalized touches.

- Luxe packaging and brand desirability make shoppers eager to share their purchases on social media — driving a network effect of engagement.

The D2C model is also highly efficient.

The risk of over-manufacturing is reduced since there's no chance of bulk ordering from buyers — the buyer is the individual who will wear the product, not a retailer middleman.

Brands also don't need to fight for product placement in stores or worry about setting up and monitoring in-store promotions. Supply chains are also streamlined since there are no intermediaries between the brand and its audience.

Those benefits create additional advantages that can help D2C brands appeal to modern consumers.

Control over the brand is one: The brand isn't fighting for retail buyers' interest. The only audience a D2C label has to please is the one it organically created.

There's also less need for D2C brands to shift their look or style to suit passing fads or trends. Instead, they can align their brands with the values of their target consumer.

D2C brands also own their customer engagement data, which allows them to understand demand and sentiment in precise, targeted ways.

This helps create a digital feedback loop as brands produce new product lines and choose new color palettes. They have close relationships with consumers and can use social media signals, customer service interactions, and prior e-commerce behavior to inform decisions about what to design next.

By keeping supply chain complexity to a minimum and focusing on quality, D2C fashion brands can also maintain higher sales margins and shift pricing strategies as they please — creating more ways to make money from marked-down inventory.

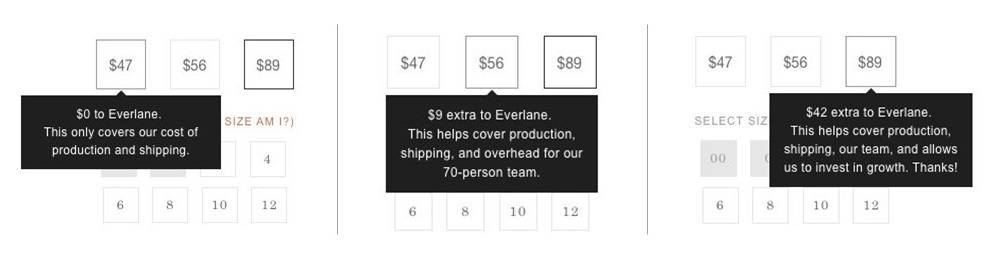

Everlane, for one, built its thriving business around supply chain and pricing transparency: An infographic about the cost of manufacturing a designer T-shirt (and how much cheaper Everlane's was) helped the brand attract 200,000 user-members in just a year.

A key piece of Everlane's e-commerce strategy is also its "Choose What You Pay" feature, which allows members to select from different "recommended" prices for past-season styles. Depending on which price you select, Everlane breaks down where your money is allocated across production, overhead, and company growth.

With conventional apparel retailers closing up shop and D2C brands taking off, traditional fashion brands like Tommy Hilfiger are now following the cues of early leaders and becoming more D2C-focused.

FROM OWNERSHIP TO USERSHIP: THE RISE OF CLOTHING-AS-A-SERVICE

The advent of the internet has disrupted traditional models of ownership across a number of different product categories. Consumers have traded CD collections for Spotify subscriptions, DVD shelves for Netflix memberships.

Now, the shift from ownership to usership is coming for fashion.

What's driving the change? A growing consumer desire for variety, sustainability, and affordability. The average consumer today buys 60% more items of clothing than they did 15+ years ago — but consumers keep that clothing for only half as long as they used to.

One in 7 consumers said they consider it a fashion faux-pas to be photographed in the same outfit twice, per a survey of 2,000 respondents. And as we've seen, sustainability is a growing concern among shoppers — as is, of course, cost.

Clothing rental concepts offer consumers an avenue to continually refresh their wardrobe, while also protecting both the environment and their wallets.

Rent the Runway is a fashion rental service that allows members to rent designer fashion items, either on a per-piece basis or a regular monthly basis. The company achieved unicorn status in March 2019, reaching a $1B valuation after receiving $125M in Series F funding. However, it permanently closed the 5 stores it was operating in August 2020 to focus on drop-off sites and digital.

Gwynnie Bee is taking a size-inclusive approach to the rental trend, offering fashion brands that are inclusive of all sizes (0-32), including Calvin Klein, Adrianna Papell, and others.

China-based YCloset allows users to rent clothes and accessories for a monthly membership fee, and customers can buy pieces outright. To date, YCloset has raised $70M from investors, including Alibaba and Sequoia Capital China. According to the platform, it has more than 15M registered users.

Vestiaire Collective is also an online marketplace where customers can buy pre-owned luxury and fashion products. The French company's quality control team verifies items for authenticity before shipping them to buyers. Vestiaire grew rapidly in 2020 and says it has had around 140,000 new weekly listings in 2021, expanding across Europe, North America, and Asia. In April 2021, Vestiaire reached unicorn status after raising $215M at a $1B valuation.

Max Bittner, Vestiaire Collective's CEO. Source: Vestiaire Collective

And although many retail and fashion brands took a heavy blow because of the Covid-19 pandemic, the market for secondhand clothes has grown in popularity. In the UK, for instance, the rental platform By Rotation more than doubled its user base from 12,000 to 25,000 between March and September 2020.

Established brands are starting to explore the rental trend as well.

Banana Republic, Urban Outfitters, Bloomingdale's, Vince, American Eagle, and Express have all introduced subscription rental programs that allow subscribers to rent items for a monthly fee.

Vince, Express, and American Eagle have partnered with the same third-party vendor, CaaStle, to implement its "clothing-as-a-service" model. CaaStle bills itself as a "fully managed service for retailers" that complements existing retail channels.

The B2B rental tech platform has also expanded its services in the UK, working with menswear retailer Moss Bros. to launch a subscription rental service called MOSSBOX.

Resale is also gaining traction. Nike has launched Nike Refurbished, a return program that collects and sanitizes used shoes and then offers them for sale at a marked-down price. The program accepts 3 types of shoes: like new, gently worn, and cosmetically flawed. Products that are truly at the end of use are recycled.

Automated warehouses

Retailers are turning to automation and robotics to improve warehouses amid a pandemic-induced surge in e-commerce sales. Decathlon, a French sporting goods retailer, teamed up with the logistics specialist DHL Supply Chain to deploy a number of robots in its Sydney warehouse. These robots will autonomously move goods around to help human workers to ship more customer orders, minimize manual labor, and reduce errors.

Decathlon Australia CEO Olivier Robinet says that the company needed an affordable and automated way to more effectively manage 15,000 SKUs in its fulfillment center. "The solution was automation," Robinet says.

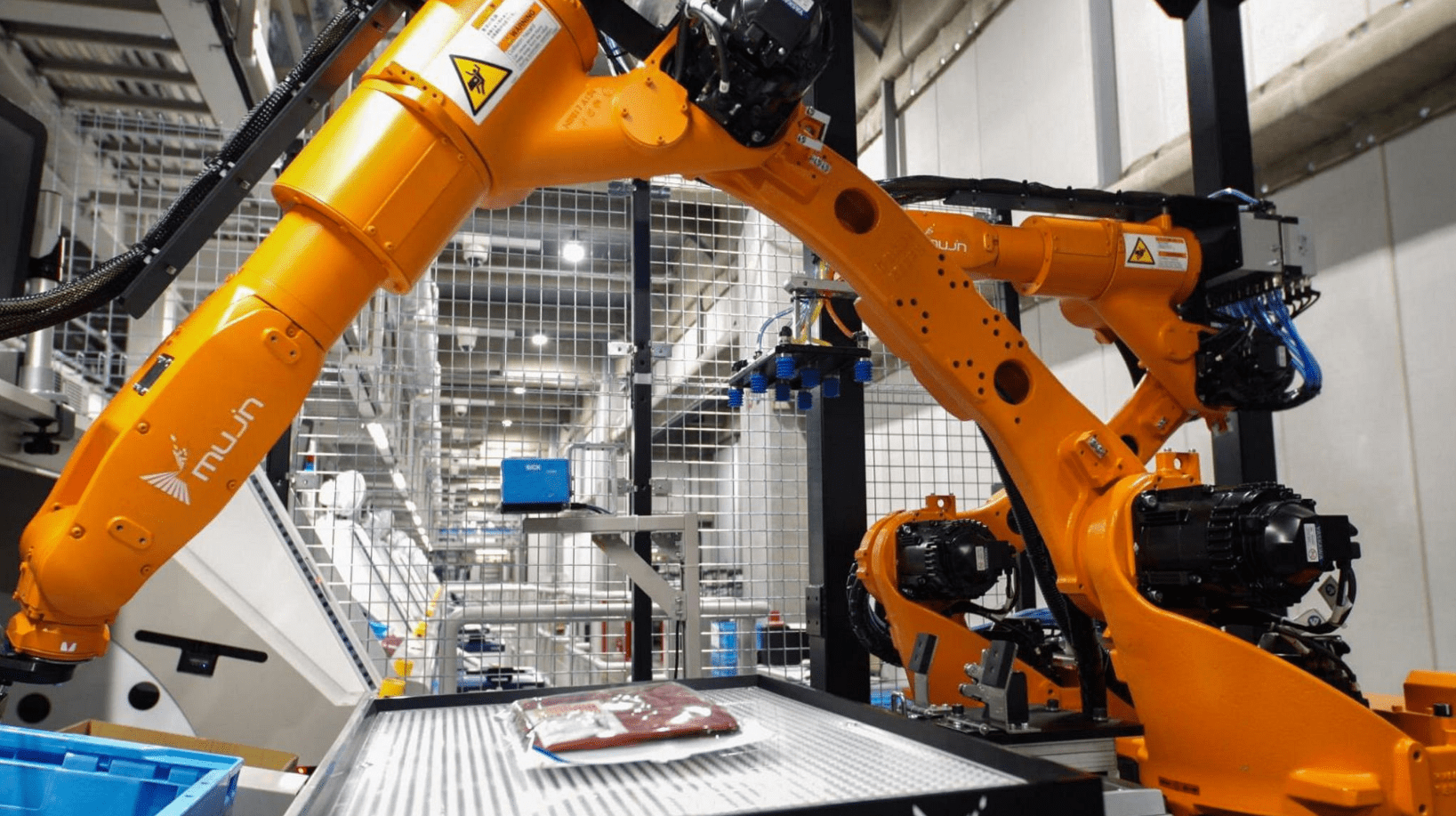

Labor shortage is another factor driving the rise of automation technologies. Uniqlo, a Japanese clothing retailer owned by the Fast Retailing group, struggles with hiring enough workers for its warehouses. Japan is an aging society with a low birth rate, and the labor shortage issue will only get worse in the decades to come.

To overcome this challenge, Uniqlo has already automated around 90% of its main warehouse operations in Tokyo. The retailer has also installed a two-armed robot developed by the robotics startup Mujin that could help automate the remaining 10%. The robot is capable of picking up t-shirts and boxing them before they're shipped to customers — dealing with soft materials in this way is a tough task for robots since it involves being relatively delicate and using intricate movements.

Uniqlo uses a Mujin robot that can box t-shirts and prepare them for shipping. Source: Mujin

Retail & Virtual Merchandising

Tech responds to the retail "size correction"

As large retail spaces close around the country, smaller stores are shuttering too, even in urban shopping hubs.

But physical retail isn't going away — its purpose is just evolving.

As fashion brands continue to tailor their lines to smaller, more targeted customer audiences (and use D2C strategies to reach them), they no longer need to stock vast lineups of inventory in standalone shops or large department stores.

What many brands do need are stores that help build or strengthen a connection between the customer and the label, creating a sense of excitement or urgency.

AR/VR Redefines The Online and In-Store EXPerience

Augmented reality and virtual reality tech are increasingly being deployed to create digital experiences in stores and "in-store" experiences online.

Several startups are helping brands enter a new era of experiential shopping. Obsess, for example, helps labels use AR or VR in 3 key areas:

- E-commerce: Increase conversion by letting online/mobile shoppers see products in 3D in context in front of them

- Physical retail: Use AR in-store to let shoppers access digital media on in-stock merchandise

- Marketing: Create virtual or augmented experiences that "delight consumers" — like an AR pop-up, interactive catalog, or VR recreation of a store or boutique

As part of Walmart's Innov8 VR competition, Obsess created a photorealistic CG virtual store for Rebecca Minkoff. The experience included the ability to shop racks using a headset and complete the checkout process in VR. In 2019, the company worked with Tommy Hilfiger to create a virtual version of a pop-up store for the brand's collaboration with actress and singer Zendaya.

"What we're trying to show here is that shopping in the future will be a combination of some elements of what physical stores have today, like visual merchandising and curated pieces, but then they have all of these other things that are not possible in physical stores." — Neha Singh, founder and CEO of Obsess

VR stores may take off as the tech continues to get cheaper and more immersive.

For example, brands could ship headsets to high-end, repeat customers, or have headsets on hand in smaller stores to walk buyers through an entire collection. VR fashion shows are already being streamed by Victoria's Secret, Tommy Hilfiger, and other labels.

Meanwhile, augmented reality is turning marketing materials into 3D experiences: Maggy London, for example, worked with Code & Craft to create an AR catalog for mobile. Created using 3D scanning and Apple's ARKit, users could put a mobile phone up to items in the catalog and view them as realistic, virtual 3D products.

3D scanning and AR are also reinventing the fitting room — at home and in stores.

Source: Uniqlo

TopShop has used in-store AR mirrors so customers don't need to get physically undressed to try on clothes, while Uniqlo's Magic Mirrors let customers see how apparel they try on in-store looks in different color options.

Neiman Marcus has introduced similar technology in some of its stores, partnering with MemoMi Labs to install 58 of the company's Digital Mirrors in 37 locations in 2017.

In 2019, the company unveiled its first Manhattan location in Hudson Yards, and with it a vision of what a tech-enabled retail experience of the future might look like. Technological innovations featured in the 188,000-square-foot location included:

- Over 60 screens that broadcast promotional messages and real-time content across the store

- Memory Makeover mirrors that let shoppers record beauty demonstrations and makeup tutorials to be texted or emailed to them for future reference

- A smart fitting room experience powered by AlertTech that allows customers to customize their lighting, communicate with store associates, and check out directly from the fitting room

- A voice-controlled customer service platform by Theatro that uses artificial intelligence to help optimize associates' time on the floor

However, Neiman Marcus closed its Hudson Yards location in July 2020 following its bankruptcy filing.

Meanwhile, in footwear, the AR-powered Converse Sampler app allows users to select any shoe from the Converse catalog and see how it will look just by pointing their phone at their feet. Allbirds uses similar AR tech to offer at-home "try-ons" via its app.

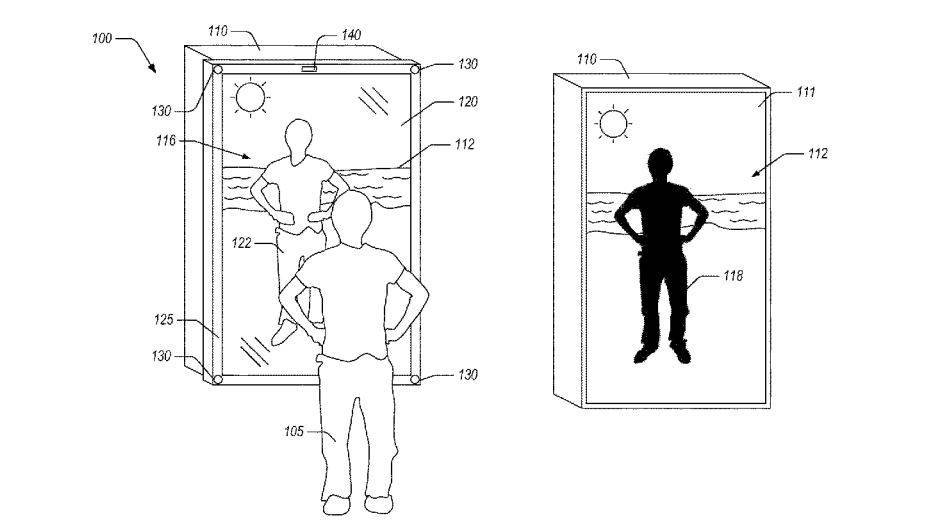

Amazon's fashion plans also include virtual try-ons: A few months after its 2017 acquisition of 3D scanning startup Body Labs, the e-commerce giant applied for a patent for a "blended reality system" to create an AR mirror for at-home try-ons.

The patent was granted in January 2018. If commercialized, Amazon's mirror invention would place users in virtual clothes and in virtual settings, allowing them to see what a dress would look like on the gala floor, or see a new swimsuit at the beach, before completing a purchase.

Source: USPTO

In June 2020, Amazon researchers unveiled an AI-powered virtual try-on system, Outfit-VITON, which helps customers visualize how certain garments would look on their bodies.

DIGITAL STYLISTS GET PERSONAL

AI-based digital stylists and chatbots, which can give feedback on outfit choices or suggest alternatives, are also taking off.

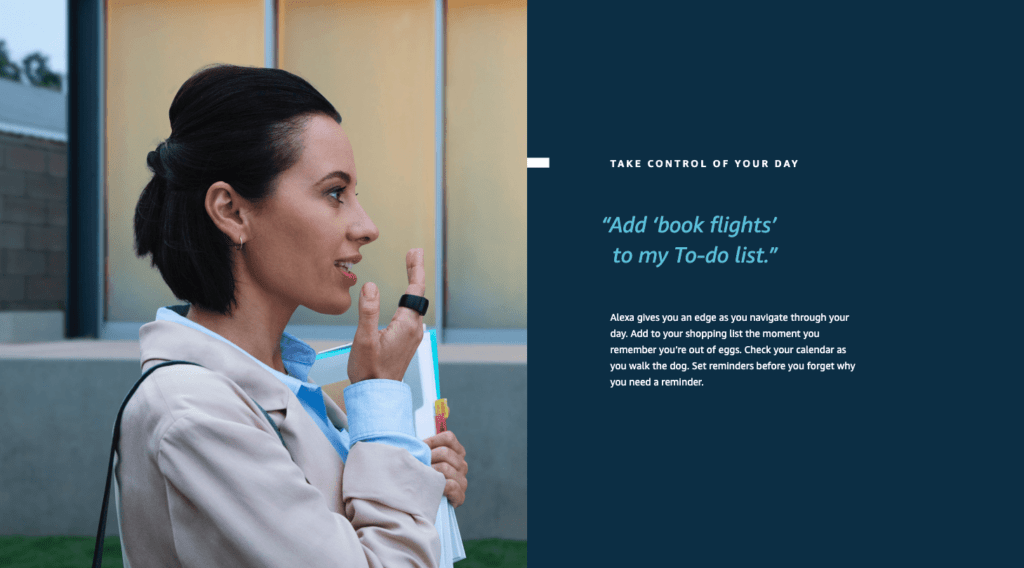

In 2017, Amazon launched the Echo Look, a device that would take full-body photos of your outfit and suggest clothing for new looks, but discontinued the product in May 2020. Much of the functionality was integrated into Amazon's Alexa assistant, which can now suggest apparel for customers through the Amazon Shopping app.

Amazon has also introduced StyleSnap, an AI-powered feature that lets customers upload photos or screenshots of fashion items they like. The system then gives recommendations for similar items listed on Amazon. StyleSnap also considers price range, customer reviews, and other factors when suggesting items that match the uploaded photos.

Other tech giants have developed similar technologies. Google Lens, for instance, enables users to upload photos of fashion products they like and then displays similar products found online. And Facebook is experimenting with an AI system of its own called Fashion++. The software uses AI to analyze a person's outfit and suggest subtle alterations that it thinks could improve the look, like rolling up the sleeves or removing an accessory.

Asos, meanwhile, launched a "gifting assistant" chatbot on Facebook Messenger for the 2017 holiday season. The chatbot helped customers pick out presents for loved ones by asking questions like, "What item would most likely fall out of their bag?"

Even luxury brands are testing digital stylists in select markets: Prada, for example, has introduced a "personalized concierge" chatbot for its relaunched Chinese website.

Digital assistants have lots of personalization potential in fashion. As visual search and recommendation systems improve with AI, users will be able to send bot stylists photos of items they like and get suggestions for similar items.

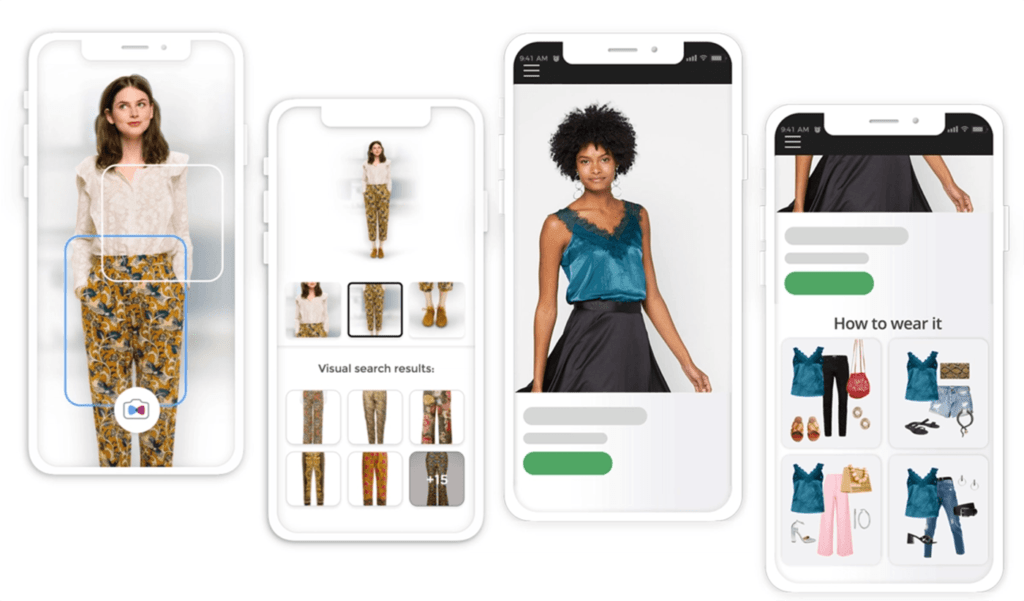

Source: Syte

Israel-based Syte is one company working in this area, offering retailers and brands a camera button that can be added next to the search bar on a mobile website or app. Shoppers can upload images of their favorite styles through the button, and then see looks "inspired" by those images on the brand's site. Syte counts a number of high-profile brands among its clients, including Tommy Hilfiger, Myntra, and Kohl's.

UK-based company Snap Tech offers a range of visual search tools for publishers, retailers, and influencers, including Snap SDK, which allows clients to turn their iOS and Android apps into visual search tools, and the Snap the Look widget, which lets customers "steal" looks directly from photos.

Singapore-based startup ViSenze AI launched "Shoppable User Generated Content," a visual recognition tool that "understands and tags user-generated contents, making items within images easy to discover, search, and purchase." ViSenze counts prominent brands including Myntra and Urban Outfitters among its clients.

Thread Genius, which developed similar technology for use in fashion, art, and interior design, was acquired by Sotheby's in January 2018. In the year following the acquisition, Sotheby's reported a 16% increase in sales, thanks in large part to the strong growth of the company's online business.

And some shopping apps are integrating social media components. The Yes, for instance, is a shopping app that lets users invite friends to view and rate their list of liked items, called "Yes lists." Friends can use emojis to rate individual items, including a thumbs-up and a thumbs-down, and users also get notified when their friends like other products. Over time, the app learns user preferences and builds a personalized feed.

What's Next? High-Tech Fashion Trends To Watch

A look at the catwalk of the future

Just as tech is touching every aspect of the fashion supply chain, it's also being integrated into the features of the clothing itself. The era of "connected apparel" is already here and moving out of the novelty realm.

Wearable Tech: jewelry, apparel, & footwear

Wearable technology has been on the market for some time, from the earliest days of the FitBit to the latest iterations of the Apple Watch and Google Glass. Now, fashion leaders are merging form and function to make wearables more stylish and functional.

Wear OS — Google's smartwatch operating system — is now live in watches from brands like Michael Kors, Tag Heuer, Montblanc, ZTE, Asus, Huawei, Fossil, and Diesel. Formerly known as Android Wear, Wear OS has undergone a number of updates and changes since 2017, including new features, more standalone apps, and a better user experience for iPhone users.

Amazon unveiled its Echo Loop smart ring in 2019, which will allow wearers to summon the Alexa assistant on-demand and make phone calls.

Source: Amazon

Finland-based Oura makes a smart ring that tracks wearers' activity, including sleep quality, heart rate, body temperature, and more.

Fashion brands and startups are also partnering up to create connected bracelets, rings, and necklaces. Past collaborations have included Tory Burch and Fitbit, as well as Swarovski and Misfit Wearables.

Beyond jewelry, the latest fashion tech innovations embed app-connected hardware right into our clothing.

Since 2017, Levi's and Google have teamed up on a line of smart denim jackets that can recognize gestures and perform various acts such as playing the next song in a playlist or declining an incoming call. Users customize their gesture controls in a companion app.

The jackets rely on a material Google developed called Jacquard Threads, the "first full scale digital platform created for smart clothing." The threads are made with hyper-thin conductive metal alloys, which can be woven into natural and synthetic fibers and integrated with embedded sensors. They're even machine-washable.

"Gesture-sensing Jacquard Threads are woven into the cuff and wirelessly connected to your mobile phone using tiny electronics embedded inside the sleeve and a flexible snap tag." — Dr. Ivan Poupyrev, Google engineering director

Samsung has also demoed connected tech garments that look and feel like clothes you already wear. Its Body Compass workout suit features hidden sensors that can track your workouts or wellness metrics, while its Smart Suit features gesture-controlled, app-connected cufflinks.

Startups are also tackling the wearables market: Wearable X pushed out a line of yoga pants that vibrate to cue wearers to move or hold their yoga positions; Owlet's smart sock monitors babies' oxygen levels and heart rates; while Hexoskin has a line of smart shirts that track heart rate, breathing, and movement.

Advances in wearable tech will make our clothes more functional, as well. You can already buy a phone-charging jacket from Baubax, and MIT researchers have developed self-ventilating garments capable of cooling you as you work out. During the Pyeongchang Winter Olympics, Ralph Lauren equipped Team USA with app-controlled, heated parkas.

Smart shoes are also gaining traction.

Nike's Adapt sneaker line allows wearers to control the fit of their shoelaces electronically and personalize shoe lighting from an app, while Under Armour's HOVR sneakers come equipped with sensors that track activity.

Lechal makes navigation-assisting shoes, which connect to a mapping app and apply gentle vibrations to your feet to guide you "invisibly but intuitively."

Virtual fashion

Fashion is even moving beyond the world of physical retail.

As people spend more time online, virtual goods — items that you cannot touch and can only be accessed and traded in virtual environments — could represent a $190B market by 2025, according to CB Insights' Industry Analyst Consensus.

In 2019, digital fashion house The Fabricant garnered headlines for selling a virtual dress for $9,500 through the Ethereum blockchain. The dress could only be "worn" digitally, i.e., edited onto the wearer in post-production.

Source: The Fabricant

Startups and fashion incumbents alike have begun experimenting with new virtual lines, whether it be for real people or digital avatars.

Tribute, Dress X, and Replicant.Fashion are examples of digital fashion brands that tout "contactless," "zero-waste" clothing — because their garments are virtual-only.

While in-game skins aren't new, luxury brands are increasingly moving into avatar fashion for video games. In 2019, Louis Vuitton released a League of Legends collection, while Moschino released one for The Sims.

Gucci has increasingly bet on virtual fashion, releasing a digital collection for a styling app, exclusive outfits for a tennis game, virtual looks for Genies avatars, and, soon, sneakers for location-based mobile game Aglet.

Described as "Pokémon Go for sneakerheads," Aglet allows players to collect virtual shoes from brands like Nike, Chanel, and Balenciaga. Users can earn in-game currency by taking steps, referring friends, or spending real money to acquire sneakers in the app.

Fashion brands are now turning to NFTs in an attempt to build new revenue streams. Even Gucci has signaled that it's interested.

Marjorie Hernandez, who founded the blockchain platform Lukso, says that "luxury brands were behind on the e-commerce trend, so there's now more of a willingness to experiment with new technologies like blockchain." And many tech startups are eager to help fashion brands make the jump.

Neuno, for instance, is working with a handful of luxury brands to launch NFTs. The Sydney-based startup is developing 3D wardrobe tech that allows users to buy iconic outfits, such as J Lo's famed Versace dress. These users can then go to social media and post photos of themselves wearing these outfits. Neumo also wants to partner with game developers to enable users to dress their avatars in the clothing they bought as NFTs.

Clothia, a luxury marketplace, is auctioning NFT-linked clothing items. The winning bidders receive real-life clothes as well as the corresponding NFTs.

Meanwhile, Arianee, a French startup, is developing a digital protocol that uses NFT-based watermarks to authenticate luxury items, including expensive watches, handbags, and more. In March 2021, Arianee raised $9.6M in seed funding. The company is working with watchmaker Breitling as well as the luxury conglomerate Richemont Group. LVMH, the French giant behind brands like Tiffany and Dior, is also exploring the use of NFTs as an authentication method.

Details of the Arianee NFT protocol. Source: Arianne

And as more and more brands and consumers engage each other in online worlds, the emergence of "metaverse malls" looks more realistic. These malls would be new sales channels and virtual spaces in which shoppers could talk to other shoppers, explore digital fashion items, and enjoy an immersive experience. Gaming platforms like Fortnite and Roblox offer a glimpse of how metaverse malls might look.

But creating metaverses requires huge amounts of computing resources, engineering talent, and cash. This concept is therefore likely a while away yet, and bringing it to life will require a sustained effort by tech giants, innovative startups, and fashion brands.

3D scanning in The Apparel Industry

Finding the perfect fit when shopping for clothes online is difficult, but 3D scanning and clothes-fitting tech could change that. Retailers are hoping that this tech could also reduce returns.

TG3D Studio, for one, has developed a 3D body scanner to ensure a tailored fit. Users get scanned via an app and can dress up their avatar in different garments to see how they fit.

Virtual try-on solutions are being offered by other companies as well. Israeli startup Zeekit's platform allows shoppers to virtually try on clothing items from online stores. This technology is already integrated into the websites of major retailers, including Walmart, Macy's, and ASOS. US-based Forma offers a "virtual dressing room" that can be integrated into a store's app to allow users to visualize themselves in different clothing.

Fit:Match has rolled out 3D scanning solutions to help with sizing. First, a 3D camera scans in-store shoppers. The software then asks users about individual preferences before suggesting a list of clothing items from retail partners. Customers also get an ID that they can use in the future and when shopping online.

Even social media company Snap is jumping on the virtual try-on bandwagon. In March, the social media firm announced that it was acquiring Fit Analytics, a German startup that uses machine learning and customer details to recommend well-fitting clothes. Snapchat will use Fit Analytics's tech to improve its in-app purchase and e-commerce features as well as to collect more customer data.

Similarly, US-based startup Naked Labs has developed a 3D scanning product. The company offers a smart mirror that captures a 3D model of the person standing in front of it. Once the scan is complete, users get information on their body size, proportions, and other parameters. These data points can be used to both track health and enable businesses to produce made-to-order clothing items.

Meanwhile, LikeAGlove has developed smart leggings that measure users' figures and use the data to point them to specific styles and brands of pants that will fit them best.

Nike took a slightly different approach to help customers find shoes that fit well. The US footwear giant allows its app users to scan their feet using a smartphone to measure their shoe size. The app stores data in the user's profile to be used for other online and in-store purchases.

As brands increasingly deploy 3D scanning for virtual try-ons, these kinds of smart garments will support greater personalization and the future of "augmented commerce."

novel fabrics

Novel fabrics made of next-gen materials may also find commercial adoption in the future of fashion.

Startups like Modern Meadow are developing lab-grown leather without harming animals, while Bolt Threads is innovating to turn super-strong spider silk into a readily accessible fabric source.

Bolt Threads is also developing a mushroom-based leather substitute. Adidas, Lululemon, and several other fashion brands will be among the first companies to use the new material in their products in 2021.

Athlete Tom Brady apparently sleeps in pajamas with a "bio-ceramic print" that combines with body heat to produce far infrared radiation (FIR), which is meant to reduce inflammation, improve circulation, and help the body recover faster.

Fashions that change color may be coming too. While Hypercolor color-shifting t-shirts and mood rings had a moment in the 90s, the latest iterations are far more sophisticated.

MIT researchers created a system called ColorFab 3D, which 3D prints objects with "photochromic inks" that change color when exposed to certain wavelengths of UV light. The first item ColorFab created with the technology is a ring that can be programmed to change into a handful of preset, customizable colors.

The team behind Google's Jacquard Threads is also making color-shifting possible with Ebb, a color-changing fabric technology (developed with UC Berkeley researchers) that could someday be programmed to change with your mood or setting.

And with the same kind of app connectivity seen in the Levi's Jacquard jacket, the Ebb materials could even help you conduct many activities you currently do on your phone with color signals instead — for example, alerting you to an incoming call by changing the color of your cuff.

"If you can weave the sensor into the textile, as a material you're moving away from the electronics," Google's Ivan Poupyrev says. "You're making the basic materials of the world around us interactive."

Synthetic media

Synthetic media is content created using AI. Smart algorithms ingest voices, videos, photos, text, and other types of data to learn and then produce realistic digital content. This software can be used to mimic the looks, sounds, and mannerisms of specific individuals.

Fashion brands could use synthetic media in various ways. For example, the tech could accelerate the creation of digital content for e-commerce product pages by rapidly generating images and videos of human models wearing new styles.

Advances in tech like pose iteration could make these synthetic models extremely realistic. AI-generated human models could also speak in various languages and be quickly tailored to different audiences. Eventually, brands may find that synthesizing voices and videos using AI could be cheaper than hiring human models for some marketing campaigns.

Synthesia's tech was used to generate a video of David Beckham speaking nine languages. Source: Synthesia

Companies such as Synthesia are already showing what's possible in this field. The AI video synthesis platform generated a video of David Beckham speaking 9 languages to raise awareness for the Malaria Must Die initiative. Companies such as Axiata Group, Accenture, and McCann have also used Synthesia's tech in their marketing campaigns. And although synthetic media tech is still in its early stages, it's showing enough promise that fashion brands should start paying attention.

Cryptocurrencies

Cryptocurrencies, such as Bitcoin, are surging in value. Customers can use bitcoins to buy a Tesla or coffee at Starbucks, and some luxury brands are jumping on the crypto bandwagon as well.